Despite Short-Term Cyclical Downturn, Global Semiconductor Market’s Long-Term Outlook is Strong

Wednesday, Feb 08, 2023, 10:00am

by Semiconductor Industry Association

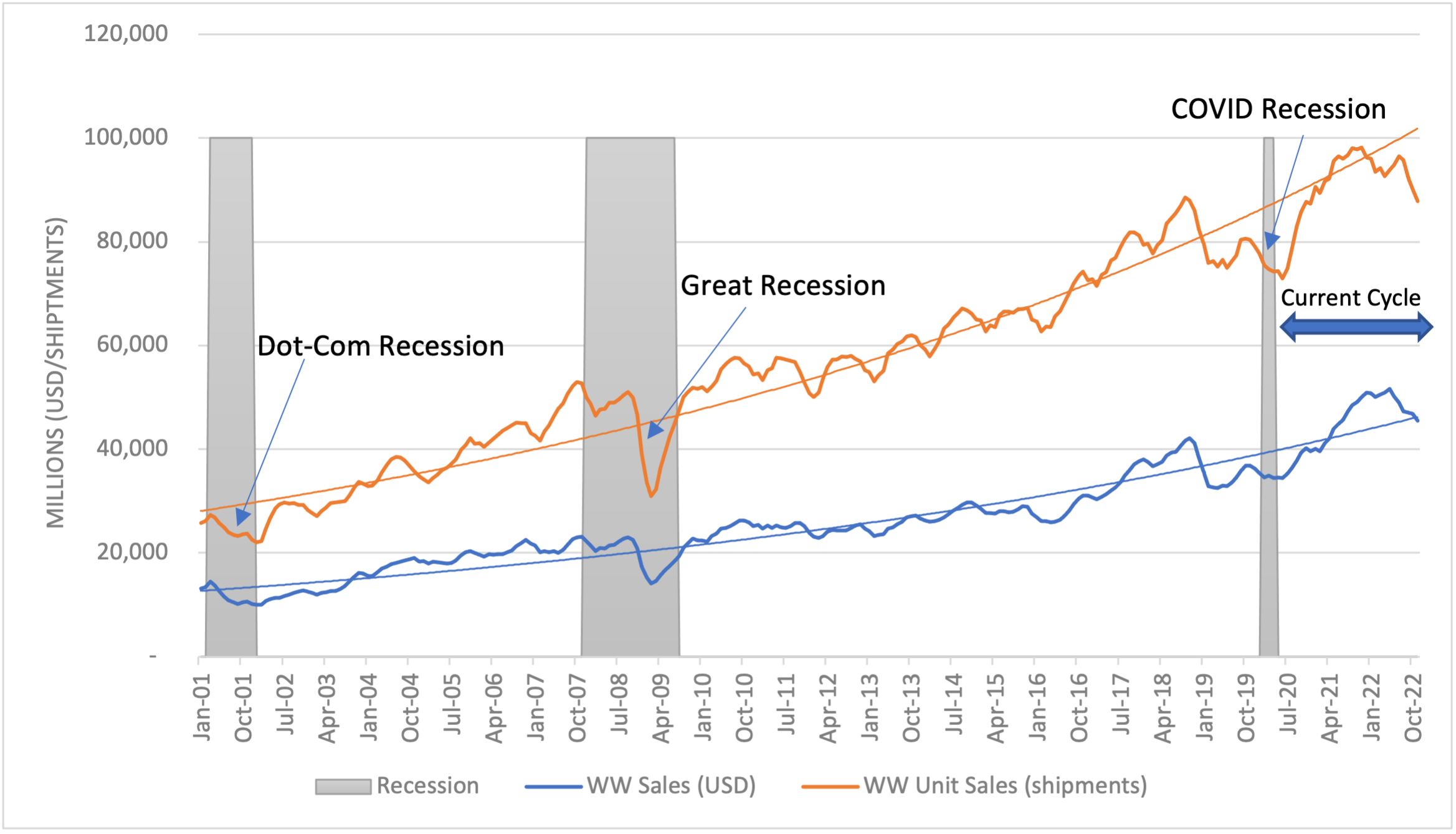

Global semiconductor sales data released last week showed the industry experienced significant ups and downs in 2022. While chip sales reached the highest-ever annual total in 2022, the slowdown in the second half of the year substantially limited growth. A deeper dive into the year-end data reveals how this pattern is consistent with the semiconductor industry’s predictable cycle and why the current short-term downturn does not change the reality that long-term growth prospects for this foundational technology remain very promising.

In the current cycle, after a brief downturn in early 2020 at the start of the pandemic, the semiconductor industry experienced a period of tremendous growth, and now it is on a significant downward trend that started in the second half of 2022. The current short-term downturn is the result of a confluence of factors, including increasing inflation, geopolitical unrest, and lingering effects of the pandemic. These factors have contributed to macroeconomic uncertainty, decreased consumer spending, and fluctuations in demand for semiconductors. For example, as household spending on consumer electronics like PCs, smartphones, and tablets has decreased, so too has demand for the semiconductors that power them.

Indeed, macroeconomic headwinds have created significant short-term challenges for the semiconductor industry, resulting in weaker industry growth in 2022 than was previously expected. This short-term adjustment, however, does not change the structural drivers of industry growth that are expected to reassert themselves and propel continued growth over the long term. The net of this is semiconductor demand will grow over the long term, as chips continue to make the world smarter, more efficient, and better connected.

In fact, zooming out from short-term demand fluctuations and looking at the long-term trend over the last two decades, the semiconductor industry has shown consistent growth (figure 1). Annual sales grew from $139 billion in 2001 to $573.5 billion in 2022, an increase of 313 percent. Over this same period, unit sales of semiconductors increased by 290 percent, reflecting the increased demand for semiconductors throughout the economy. In fact, a 2020 study by SIA and the Boston Consulting Group found that global demand for semiconductor manufacturing capacity is projected to increase by 56% by 2030. As this long-term trend continues in the years ahead and demand for chips rises, semiconductor companies will need to invest in more research, design, and manufacturing. The question is not whether more chip manufacturing facilities, or fabs, will be built, but rather where they will be built.

To ensure a large share of that new manufacturing capacity is built in America, leaders in Washington last year enacted the CHIPS and Science Act, a landmark law providing substantial chip manufacturing incentives and research investments. The early impact of the CHIPS Act has been very promising. From the time the CHIPS Act was introduced in the spring of 2020 through the months following its enactment, companies in the semiconductor ecosystem announced more than 40 new projects in the U.S. totaling nearly $200 billion in private investments and more than 200,000 direct and supported jobs throughout the U.S. economy. Thanks in part to these new projects, the total number of direct jobs in the semiconductor industry alone could reach 312,000 by the end of the decade, with the industry supporting a total of 2.1 million direct, indirect, and induced jobs in the U.S. economy.

The semiconductor industry has a long history of investing big during down cycles to be ready for the inevitable rebound in demand. New company investments will lead to more domestic semiconductor production and innovation, which will help avert future chip shortages and ensure the industry meets the growing demand from sectors like the automotive, data storage, and wireless connectivity industries. The automotive industry, for example, is estimated to be responsible for 20% of chip demand, and the wireless communication industry is projected drive 25% of growth by 2030.[1] The strong growth drivers of these sectors will power demand in the chip industry in the next decade.

In summary, while the chip industry is notoriously cyclical and experiences brief periods of weakness in the short-term, the long-term prospects for this critical sector are incredibly bright. Chips are key to the big emerging technologies, such as AI, IoT, and 6G. They are essential to breakthroughs in medicine and innovation in medical devices. Our electric grid and climate solutions all rely on these tiny pieces of silicon that have become so important to our lives. And that reality will not change in the short-term or the long-term.

Figure 1: Sales and Unit Shipments 3 month moving average Jan. 2001- Nov. 2022

Source: WSTS and SIA analysis

[1] McKinsey & Company. The semiconductor decade: A trillion-dollar industry. April 1, 2022.