Global Semiconductor Sales Increase 3.3% in 2022 Despite Second-Half Slowdown

Friday, Feb 03, 2023, 4:30pm

by Semiconductor Industry Association

Note: This release reflects updated sales data released on March 3, 2023

Worldwide industry sales totaled a record $574.1 billion in 2022, but sales slowed significantly during second half of year

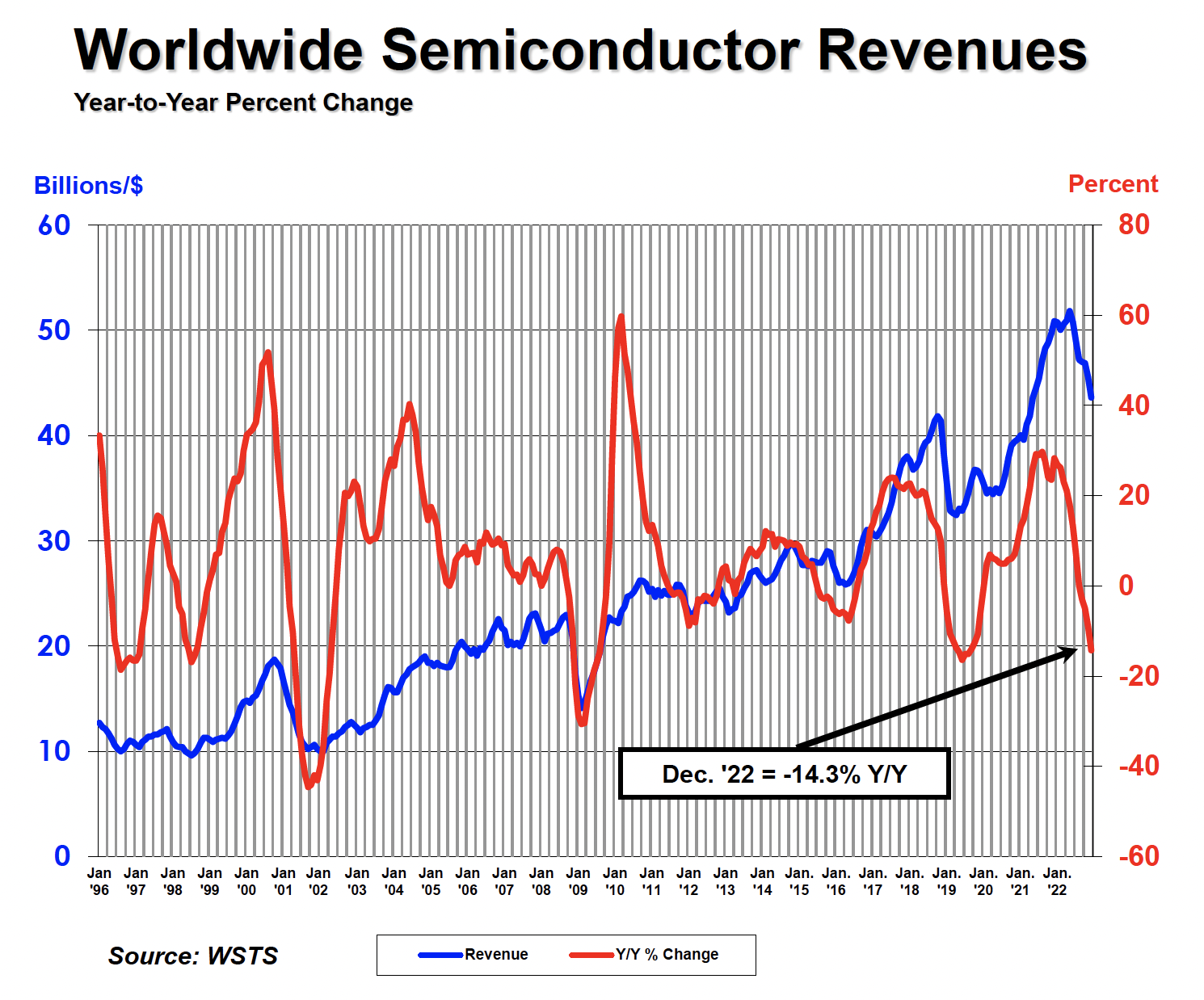

WASHINGTON—Feb. 3, 2023—The Semiconductor Industry Association (SIA) today announced global semiconductor industry sales totaled $574.1 billion in 2022, the highest-ever annual total and an increase of 3.3% compared to the 2021 total of $555.9 billion. Sales slowed during the second half of the year, however. Fourth-quarter sales of $130.8 billion were 14.3% less than the total from the fourth quarter of 2021 and 7.2% lower than the total from third quarter of 2022. And global sales for the month of December 2022 were $43.6 billion, a decrease of 4.3% compared to November 2022 total. Monthly sales are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms.

“The global semiconductor market experienced significant ups and downs in 2022, with record-high sales early in the year followed by a cyclical downturn taking hold later in the year,” said John Neuffer, SIA president and CEO. “Despite short-term fluctuations in sales due to market cyclicality and macroeconomic conditions, the long-term outlook for the semiconductor market remains incredibly strong, due to the ever-increasing role of chips in making the world smarter, more efficient, and better connected.”

“The global semiconductor market experienced significant ups and downs in 2022, with record-high sales early in the year followed by a cyclical downturn taking hold later in the year,” said John Neuffer, SIA president and CEO. “Despite short-term fluctuations in sales due to market cyclicality and macroeconomic conditions, the long-term outlook for the semiconductor market remains incredibly strong, due to the ever-increasing role of chips in making the world smarter, more efficient, and better connected.”

On a regional basis, sales into the Americas market saw the largest increase (16.2%) in 2022. China remained the largest individual market for semiconductors, with sales there totaling $180.4 billion in 2022, a decrease of 6.2% compared to 2021. Annual sales also increased in 2022 in Europe (12.8%) and Japan (10.2%). Sales for the month of December 2022 decreased compared to November 2022 across all regions: Europe (-0.6%), Japan (-0.5%), Asia Pacific/All Other (-3.4%), China (-5.7%), and the Americas (-6.3%).

Several semiconductor product segments stood out in 2022. Analog, a type of semiconductor that is commonly used in vehicles, consumer goods, and computers, had the highest annual growth rate of 7.5%, reaching $89 billion in 2022 sales. Logic ($176.6 billion in 2022 sales) and memory ($130 billion) were the largest semiconductor categories by sales. Sales of automotive ICs grew by 29.2% year-over-year to a record total of $34.1 billion.

For comprehensive monthly semiconductor sales data and detailed WSTS forecasts, consider purchasing the WSTS Subscription Package. For detailed historical information about the global semiconductor industry and market, consider ordering the SIA Databook.

[December 2022 chart and graph]

# # #

Media Contact

Dan Rosso

Semiconductor Industry Association

240-305-4738

drosso@semiconductors.org

About SIA

The Semiconductor Industry Association (SIA) is the voice of the semiconductor industry, one of America’s top export industries and a key driver of America’s economic strength, national security, and global competitiveness. SIA represents 99% of the U.S. semiconductor industry by revenue and nearly two-thirds of non-U.S. chip firms. Through this coalition, SIA seeks to strengthen leadership of semiconductor manufacturing, design, and research by working with Congress, the Administration, and key industry stakeholders around the world to encourage policies that fuel innovation, propel business, and drive international competition. Learn more at www.semiconductors.org.

About WSTS

World Semiconductor Trade Statistics (WSTS) is an independent non-profit organization representing the vast majority of the world semiconductor industry. The mission of WSTS is to be the respected source of semiconductor market data and forecasts. Founded in 1986, WSTS is the singular source for monthly industry shipment statistics.