Growth-Based Incentives, Not Tariffs, Will Strengthen U.S. Chip Manufacturing and Leadership

Thursday, Jul 02, 2020, 3:30pm

by Semiconductor Industry Association

In 2018, the U.S. imposed a 25% tariff on U.S. imports of semiconductors and other goods from China following a Section 301 investigation into China’s unfair trade practices. Since 60% of U.S. semiconductor imports from China are originally made in the U.S., distributed through global supply chains, and imported by U.S. companies for themselves, U.S. chipmakers have borne the brunt of the $750 million in duties paid on chip imports since July 2018. Some policymakers believe that imposing even more tariffs on semiconductors and other goods will “reshore” chip production to the U.S. While tariffs arguably helped bring China to the negotiating table for a broader trade deal, tariffs on semiconductors fail to incentivize domestic chip production and will only serve to further erode America’s manufacturing base and technological leadership (see SIA one-pager here).

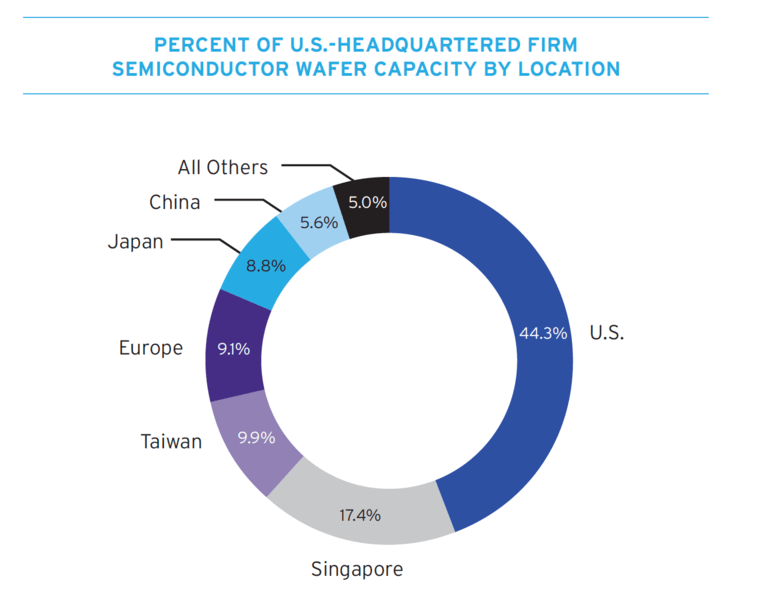

Unlike many other parts of the tech manufacturing sector, a significant portion of U.S. semiconductors are already designed and manufactured in America. U.S. semiconductor manufacturing companies have maintained approximately 44% of their front-end manufacturing capacity in the U.S., leading to a steady base of manufacturing jobs, which compared to other sectors is an impressive feat. After finished wafers are fabricated in the U.S., most companies ship them abroad for the last stage of assembly, packaging and test (otherwise known as ATP). This low-value ATP (about 10% of the value of a chip) has occurred in third countries for decades, allowing U.S. chipmakers to focus on advanced, high-value-added design and manufacturing. Imposing duties on chip imports causes U.S. semiconductor makers to pay tariffs on their own goods, diminishing their competitiveness by reducing available capital to invest in R&D, and raising the costs of their products at a time when China is champing at the bit to assume a leadership role in semiconductor technology, especially with regard to chip manufacturing. Moreover, while nearly half of U.S. firms’ manufacturing capacity is here in the U.S., 82% of their sales are to customers overseas, making semiconductors our 5th largest export. If the U.S. imposes WTO-illegal tariffs on chip imports from other countries, U.S. companies will face WTO-sanctioned reciprocal retaliatory tariffs in these important overseas markets, which will negatively impact the sales that support manufacturing jobs here in the U.S and undermine our $8 billion global semiconductor trade surplus.

Unlike many other parts of the tech manufacturing sector, a significant portion of U.S. semiconductors are already designed and manufactured in America. U.S. semiconductor manufacturing companies have maintained approximately 44% of their front-end manufacturing capacity in the U.S., leading to a steady base of manufacturing jobs, which compared to other sectors is an impressive feat. After finished wafers are fabricated in the U.S., most companies ship them abroad for the last stage of assembly, packaging and test (otherwise known as ATP). This low-value ATP (about 10% of the value of a chip) has occurred in third countries for decades, allowing U.S. chipmakers to focus on advanced, high-value-added design and manufacturing. Imposing duties on chip imports causes U.S. semiconductor makers to pay tariffs on their own goods, diminishing their competitiveness by reducing available capital to invest in R&D, and raising the costs of their products at a time when China is champing at the bit to assume a leadership role in semiconductor technology, especially with regard to chip manufacturing. Moreover, while nearly half of U.S. firms’ manufacturing capacity is here in the U.S., 82% of their sales are to customers overseas, making semiconductors our 5th largest export. If the U.S. imposes WTO-illegal tariffs on chip imports from other countries, U.S. companies will face WTO-sanctioned reciprocal retaliatory tariffs in these important overseas markets, which will negatively impact the sales that support manufacturing jobs here in the U.S and undermine our $8 billion global semiconductor trade surplus.

But this is only half of the story. Tariffs on semiconductors also threaten to drive away U.S. manufacturing in advanced technology sectors that rely on semiconductor technology, including must-win technologies of the future like artificial intelligence, aerospace, next-generation networks, autonomous vehicles, and robotics. If the cost of key inputs such as semiconductors is too high, tech manufacturers will be forced to contemplate relocating out of the U.S. and investing in more business-friendly countries to maintain their competitiveness vis a vis China and other nations who have not imposed similar tariffs. This would be a devastating blow to the U.S. advanced manufacturing sector, costing jobs and further eroding U.S. manufacturing and technological competitiveness. The record drop in new foreign investments in the U.S. manufacturing sector from $202.5 billion in 2018 to $78.2 billion in 2019, following the implementation of Section 301 tariffs in 2018, underscores this point (source: Bureau of Economic Analysis).

Unpacking this a bit further, it’s important to understand the economics of semiconductor manufacturing. Today, building a semiconductor fab isn’t cheap. A state-of-the art fab (i.e. a logic foundry) costs $18-27 billion to build and operate and depends on tens of thousands of global suppliers for key inputs, including equipment and materials. U.S. semiconductor companies have invested significant time and resources to develop their operations and supply chains both inside and outside the United States. High tariffs will not compel companies to abandon these fixed-cost assets and efficient supply chains that have enabled U.S. global leadership in this highly competitive, R&D-intensive and high expenditure industry.

U.S. policymakers are right to prioritize domestic fab construction given the importance of the industry to the U.S. economy, technology leadership, and national security. The reason many countries are outpacing the U.S. in semiconductor manufacturing capacity growth, however, is because those governments offer major financial incentives to attract fabs. For example, countries like China, Taiwan, Singapore, Japan, Korea, Ireland, Israel, Germany and France have offered tens of billions of dollars in direct grants for manufacturing, tax credits, equity investments, below-market loans, free or subsidized land, subsidized equipment, infrastructure development, workforce training, and more. While the 2017 tax reform was a welcome improvement, the U.S. simply does not have comparable manufacturing incentives at the federal level.

The most effective way for U.S. policymakers to attract semiconductor manufacturing is not tariffs, but financial incentives like federal grants, R&D funding, and tax credits to build fabs and research facilities as envisioned by the proposed CHIPS for America Act and the American Foundries Act. The total cost of these proposed bills to the American taxpayer would be roughly $30 billion (without tax credits), which is significantly less than the $93-185 billion price tag of 25%-50% tariffs on U.S. semiconductor imports over the next 10 years. Putting policies in place to incentivize domestic fab construction that are competitive with those offered abroad by other governments should be a priority for U.S. policymakers and build on past successes with DARPA and Sematech, which helped make the U.S. industry into the semiconductor powerhouse and world leader it is.