One-Year Extension of R&D Credit is Progress, but Congress Has More Work to Do

Wednesday, Dec 17, 2014, 9:00pm

by Semiconductor Industry Association

On Dec. 16, the Senate approved legislation that provides a one-year, retroactive extension of the R&D tax credit, as well as an extension of bonus depreciation and the CFC look-thru rule, all of which lapsed at the end of 2013. The House passed this bill on Dec. 3 and it will soon be signed into law.

While SIA supports this legislation, ensuring that research expenses for 2014 will be eligible for the credit, we are disappointed that the bill did not enhance the incentive nor extend the credit for longer than a few weeks going forward. SIA continues to advocate for a permanent extension of an enhanced R&D credit, which enjoys widespread bipartisan support in Congress.

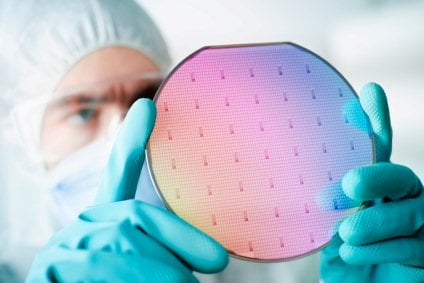

No other industry has a greater commitment to research and development than the semiconductor sector. Semiconductor companies invest about one-fifth of revenues each year in R&D – the highest share of any industry. These investments have helped the U.S. semiconductor industry sustain the pipeline of new discoveries that fuel our industry and the overall economy.

While other countries around the world have significantly increased tax incentives for private-sector research investments, the U.S. has among the weakest incentives of any developed country. Additionally, the stop-and-start approach to R&D tax credit policy makes the credit far less effective than it could be as an incentive for greater private-sector research investment. The credit has now been temporarily extended by Congress 16 times since 1981 and will expire again on January 1, 2015 – barely two weeks from now.

A robust and reliable R&D credit would drive American innovation, enhance U.S. competitiveness and create high-quality American jobs. SIA supports a permanent, modern research credit that raises the rate of the Alternative Simplified Credit (ASC) from 14 percent to 20 percent. We look forward to working with policymakers early in the new year to strengthen the credit and make it permanent.